Here they’re looking at the way in which bond defaults by corporates has risen in recent decades. That’s a useful proxy for how under stress from new market entrants the old established companies are. That stress has risen. The flip side of that being that we’ve got to be in a pretty innovative economy, things are getting markedly better and quickly. Odd to think of it this way, that more corporate bankruptcies and debt restructurings is a good thing, but that is the way it works:

Disruption and credit markets

Bo Becker, Victoria Ivashina 28 March 2019

In the past 30 years, defaults on corporate bonds in the US have been substantially above the historical average. Using firm-level data, this column shows that the increase in credit risk can be largely attributed to an increase in the rate at which new and fast-growing firms displace incumbents, a phenomenon defined as ‘disruption’. Incumbent revenue growth suffers when there are many IPOs in an industry, and newly issued bonds in high-disruption industries have higher yields.

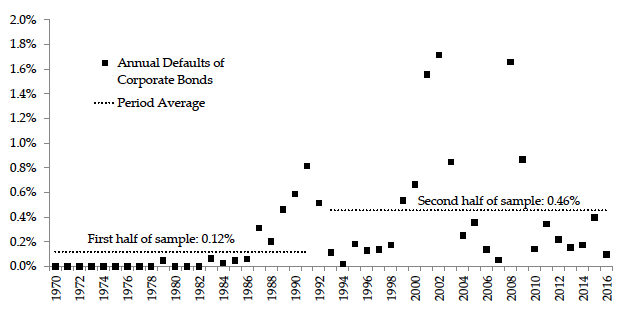

The US has seen a steady and powerful rise in corporate bond defaults in the last half century. Defaults in US corporate bonds rose almost four times between the first and second halves of the period from 1970 to 2016, from 0.12% to 0.46%. Out of the ten years with the highest default rates on corporate debt since 1960, six have occurred in the new millennium and the other four in the 1990s, according to the rating agency Moody’s (Figure 1).

Figure 1 Corporate bond defaults by year, 1970-2016

Source: Based on Figure 1 in Becker and Ivashina (2019).

Concurrently with the increase in corporate bond defaults, the rate of turnover among market leaders has increased as young firms empowered by new business models, new technologies, and global markets have challenged incumbents. We use the term ‘disruption’ for the process whereby new firms replace old firms using new technology and new business models. This follows the definition outlined by Bower and Christensen (1995, 1996), but is also closely related to Schumpeter’s (1942) creative destruction, and the idea that new firms replace old is a staple of modern growth theory (e.g. Grossman and Helpman 1991). The process of disruption causes incumbent firms to lose market share, suffer reduced profitability, and possibly default on debt obligations. Recent examples include single-location bookstores that were disrupted by chain stores,1 which were in turn disrupted by online bookstores,2 off-line travel agents that were disrupted by online services,3 and new airlines disrupting incumbents with inefficient operations after deregulation in North America and Europe.

In our recent paper (Becker and Ivashina 2019), we suggest that the increase in disruption may explain rising bond defaults. To relate disruption to defaults, we first measure the arrival of (potential) new disruptors using data on new stock market listings (the fraction of public firms in an industry whose initial public offering (IPO) date is in the last five years) and venture capital (VC) investment (amount invested in the last five years, in real terms, in the industry).

If good times in an industry affect all firms at the same time, we would expect high VC investments and increased IPO activity to coincide with strong performance for older firms, leading to low rates of default on corporate debt. If, on the contrary, new firms often succeed at the expense of old firms, we expect the arrival of new potential disruptors to be associated with poor performance for old firms. The data emphatically fit the second hypothesis – defaults on corporate bonds go up at times when there are more recent IPOs and more VC investment. This result holds for IPOs or VC, with or without controls for a host of factors that may influence defaults (including time, industry, bond characteristics such as seniority and callability, and issuer characteristics such as credit rating).

We test, and rule out, the hypothesis that technology changes themselves, without the agency of new firms, can generate higher risk. Industries with high levels of R&D, or those with high IT spending, do not experience higher defaults. Using patent data, we manage a rough separation between insider and outsider technology (whether a patent filing was by a single individual or by a firm), and find that insider patents are associated with low defaults and outsider patents with high defaults. This result points to a familiar insight. Patents, and intellectual property more generally, can protect incumbents just as well as they can provide a vehicle for challengers to break into an industry (Aghion and Howitt 1990).

The implications of these results extend beyond default prediction. We show that incumbent revenue growth suffers when there are many IPOs in an industry. Importantly, bond prices reflect the threat of disruption – newly issued bonds in high-disruption industries have higher yields. For a one standard deviation increase in the recent IPO share, bonds are issued at yields which are 6 basis points higher, holding rating, industry, and time fixed.

Our results do not indicate direct causality from VC investment or IPO activity to future defaults. An active IPO market and elevated venture capital investment may help birth more potential disruptors, but underlying causes for increased VC investment and the favourable stock market views of a firm may be found in technological shifts (e.g. information technology, mobile, and, in an earlier era, perhaps electricity), deregulation (think airlines), and globalisation. In our data, industries directly exposed to off-shoring are no more likely to see defaults, however, global markets may play an important role by scaling up the opportunities available for disruptive businesses.

Our results suggest that Google’s IPO in 2003 was a warning shot for creditors of local newspapers, reflecting the monumental shift of local advertising markets that had just begun (Kamarck and Gabriele 2015). Indeed, the most notorious newspaper bankruptcies happened a few years later (for example, the Chicago Tribune in 2008).4 Similarly, Lyft and Uber may spell trouble for car rental, taxi, and other transportation businesses, and credit markets may do well to heed the signs.

Corporate bonds are typically issued by mature firms (startups rarely access the bond market). Therefore, our results by nature inform us about how incumbents fare during disruption (we can strengthen this point by dropping any young firms from our bond sample). The importance of disruption presumably extends to other stakeholders of these firms. The corporate bond market is useful for studying disruption because bonds are liquid securities with detailed, high-quality data and well-defined default events. Furthermore, losses on corporate bonds are important because bonds are widely held. This is in contrast with the gains from disruption, which tend to be concentrated with entrepreneurs and venture capital investors (Kaplan and Rauh 2009, Kogan et al. 2017, Kaplan and Schoar 2005). Financial markets may amplify the distributional impact of disruption on labour markets (Acemoglu and Autor 2011, Autor et al. 2017). Just as low-skilled workers may see unfavorable labour income trends as technology drives disruption, small investors who invest in public bond markets but not VC may lose out financially for the same reasons.